Finance Service Cover Ratio

Finance Service Cover Ratio. Iscr less than 1 suggests the inability of the firm’s profits to serve its interest payments due on debts and obviously the principle amount of debts. The three project finance ratios that are covered here include:

Iscr less than 1 suggests the inability of the firm’s profits to serve its interest payments due on debts and obviously the principle amount of debts. In other words, dscr assesses whether the cash flow available is adequate to pay off the debt repayment obligations of the company. It is calculated by dividing the company’s net operating income by its debt obligations for that particular year.

You May Have Heard About The Debt Service Cover Ratio In Corporate Finance, Which Is A Ratio Of Ebitda To Debt Service.

It is calculated by the following formula. A debt service coverage ratio of 1 or above indicates that a company is generating sufficient operating income to cover its annual debt and interest payments. High ratio value indicates high ability whereas low value indicates less ability.

The Ratio States Net Operating Income As A Multiple Of Debt.

For purposes hereof, the term “debt service coverage ratio” shall mean the following (all as. Iscr less than 1 suggests the inability of the firm’s profits to serve its interest payments due on debts and obviously the principle amount of debts. Financial covenant interest service cover ratio.

The Debt Service Coverage Ratio, Usually Abbreviated As Dscr Or Just Dcr, Is An Important Concept In Real Estate Finance And Commercial Lending.

In this article we’ll take a. A ratio that high suggests that the company is capable of taking on more debt. The debt service coverage ratio (dscr) if the most important line item in a project finance model is the cfads , then the most important ratio is the debt service coverage ratio (dscr).

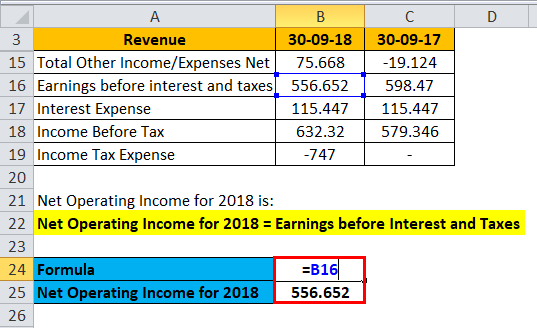

It Is Calculated By Dividing The Company’s Net Operating Income By Its Debt Obligations For That Particular Year.

Dscr is calculated as cfads divided by debt service, where debt service is the principal and interest payments due to project lenders. The debt service coverage ratio can be a very helpful metric for assessing a company’s overall financial health, and specifically how capable it is of servicing its current debt. What is interest service coverage ratio?

The Debt Service Coverage Ratio Is A Financial Ratio That Measures A Company’s Ability To Service Its Current Debts By Comparing Its Net Operating Income With Its Total Debt Service Obligations.

In other words, this ratio compares a company’s available cash with its current interest, principle, and sinking fund obligations. The debt service coverage ratio (dscr) is modelled and analysed in the vast majority of project finance flavoured transactions across all sectors. Interest service coverage ratio (iscr) essentially calculates the capacity of a borrower to repay the interest on borrowings.

Comments

Post a Comment